|

Our position The European Fermentation Group is calling for a permanent suspension of import duties on sugar for fermentation-based chemicals after the end of the sugar quota system in September 2017. The European fermentation industry needs a level playing field for access to its primary raw material on an equal footing with its competitors outside Europe. Without this, it will be a challenge to develop a strong bio-based industry in Europe. Demand for fermentation products has risen in Europe but production has actually decreased, due to uncertain regulatory conditions related to access to sugar and other raw materials. This growing demand for fermentation-based chemicals is now largely met by imports (notably from China), entering Europe with low duties or duty free: imports of fermentation-based chemicals rose from 0.5 million tonnes in 2004 to 0.85 million tonnes in 2014 (70% increase). (LMC International figures) A win-win solution is possible A permanent suspension of import duties on sugar used for fermentation-based chemicals will ensure competitive access to raw materials for fermenters. This would lead to the development a new market for fermentation products and to increased demand for sugar. As most of the sugar used by the fermentation industry comes from the EU (around 90%), an increase in the production of fermentation products would mainly benefit European farmers. If European fermenters can buy sugar at a competitive price in Europe, industry will source sugar from Europe. The possibility to import sugar from third countries would give the fermentation industry the legal certainty, necessary to trigger new investments, that access to sugar also when European sugar is not available at competitive prices. Therefore, a stable and long-term import duty suspension after 2017 could lead to renewed investment, providing new opportunities for the European sugar sector. Without this possibility, there will be no further development of the fermentation industry and market pressures from third countries will probably force fermentation companies to move production sites outside the EU, as in the past.

|

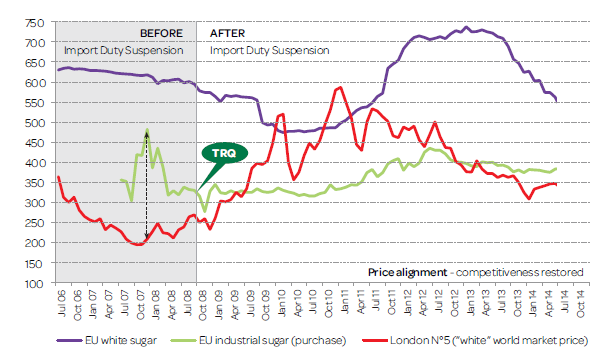

What is the current regulatory framework? Since 2008, access to sugar at world market prices has been guaranteed through an import duty suspension on imports of up to 400.000 tonnes of sugar a year for industrial uses The current system has helped to spur some minor investments and to slightly increase capacity of existing sites. However, this short-term solution has not provided the market with any legal certainty. As a result, no major new investments have been made in Europe, despite a growing demand for key fermentation products. After 2017 With the end of the sugar regime in September 2017, the distinction between sugar used for food and that used for industrial uses will disappear, resulting in the re-establishment of high import duties on sugar used for fermentation. Previously, high import duties on sugar for industrial use led to the closure and relocation outside Europe of 18 fermentation plants between 2000 and 2008. This situation can come back after the end of the sugar quota system: there is no guarantee that Europe’s own sugar production will grow and that European prices will be in line with world market prices after 2017.

Position Paper:

|

The import duty suspension has contributed to ensuring the global competitiveness of the European fermentation industry, by guaranteeing access to sugar at world market prices.

Before the import duty suspension, the European price of industrial sugar was consistently higher than the world price, leading to the closure of 18 fermentation plants in only eight years (2000-2008)